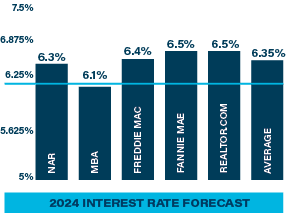

For would-be home buyers, the outlook for mortgage rates in 2024 is shaping up to be good news. The consensus opinion among economists is that rates will decline modestly this year, easing the costs of borrowing and stirring demand for home sales.

But it’s worth noting that some of the same economists predicted lower rates a year ago. We all saw how that worked out.

With inflation slowing and the Federal Reserve’s promise to cut the Fed Funds rate this year, momentum is certainly trending in favor of lower rates. But there’s still a possibility that the Fed won’t cut rates as deeply as the marketplace hopes, which could influence rates to stay flat or rise again.

Whichever way the rates roll, the best decision is to buy now, said Jason Peifer, President of The Group Mortgage LLC.

Speaking at The Group’s 2024 Real Estate Forecast, Peifer explained the need for action. If rates increase, he said buyers need to act before higher rates make housing less affordable, and before existing owners become less inclined to sell, opting to hang on to the low-rate loan rates they currently possess, a phenomenon known as the “lock-in” effect.

The other side of the coin? If rates fall, as expected, there will be more competition for available homes as buyers rush back into the market. Consequently, prices will go up. Buying now provides buyers with more selection at lower prices. And if rates fall sufficiently, you can always refinance to a lower rate.

Article provided by The Group Real Estate Insider Vol. 48, No. 2 | MARCH 2024